Wilson Metal RecyclingMetal Commodities and Recycling Report

April 27th, 2015

404 Maury St S, Wilson, NC, 27893

252-243-3586

This

is the Commodities and Recycling report, brought to you by BENLEE the industry

leader in roll off trailers and open top scrap trailers, as well as Raleigh and

Goldsboro Metal Recycling, the leaders in North Carolina for Scrap Metal,

Cardboard, Electronics and Junk Cars.

Today

is Monday, May 4 th, 2015. My

name is Greg Brown, President and CEO of the companies.

While

volumes coming in to recycling operations remain severely depressed, there was some

positive news in the commodities markets last week.

|

| AMM - Steel Production Graph - Wilson Metal Recycling |

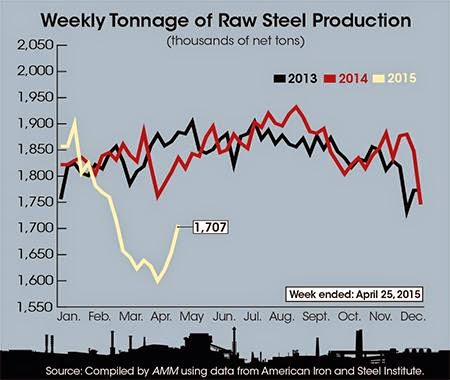

Steel

production in the United States hit a two month high and at least two steel

mills announced $20 per ton price increases.

|

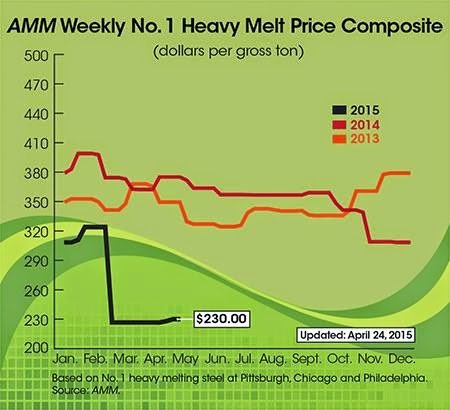

| AMM - Scrap Metal Prices Graph - Wilson Metal Recycling |

This

is leading many to believe that the stabilization in scrap steel prices in

recent months will lead to increases this week as we enter ferrous trading week.

In fact there was word of at least one

up market last Friday. On the negative

side, despite oil prices now near 4 month highs, the oil rig count, hit a new multi-year

low last week.

With

the rig count at 679 rigs that is a staggering 58% below last October’s high of

1,609. Of course this is important due

to drilling rigs use enormous mounts of steel.

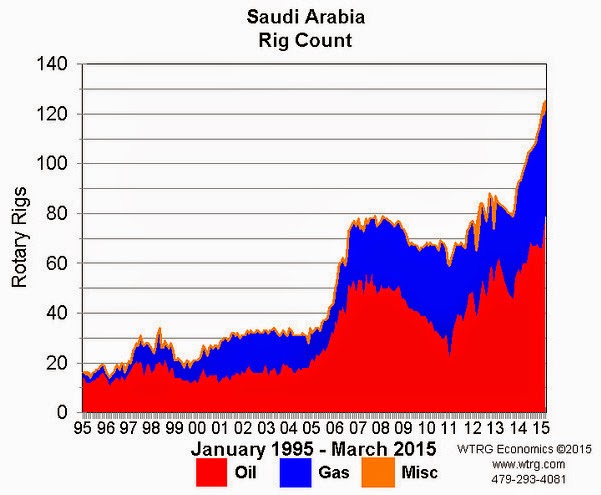

Interestingly,

Saudi Arabia is doing all it can to keep prices low and to have the U.S. reduce

our drilling. Their rig count has been

hitting historic highs in recent months.

Also, last week the large publically traded company, Waste Management released

their earnings.

While

they were up, they said that recycling commodities, which were forecasted to be

a drag on earnings of 3-5 cents per share, was now going to be worse, and would

be a drag of about 10 cents per share. This

is just another sign that while we see some green shoots in the recycling,

things are far from great.

|

| CME Group - Copper Price Graph - Wilson Metal Recycling |

As

for positive news, last week’s good economic news in Europe, caused the Euro to

strengthen to a two month high of 1.12 to the dollar, up from $1.05 of a few

weeks ago. The weakened dollar was a key

reason, that copper hit multi month high last week.

|

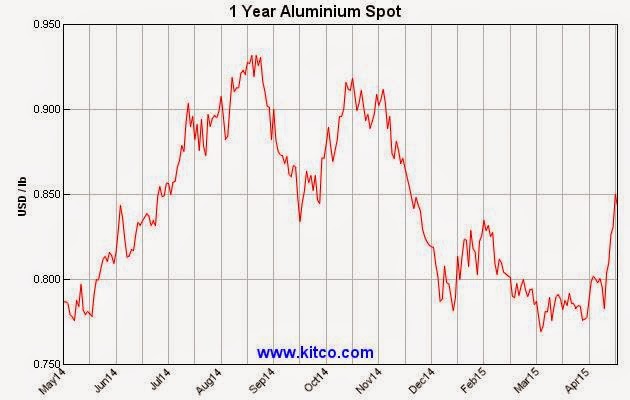

| Kitco - Aluminum Metal Prices - Wilson Metal Recycling |

Aluminum,

while not back to where it was about 6 months ago, hit at multi month high and is

now actually higher than it was a year ago.

|

| tradingeconomics.com - US Personal Savings Rate - Wilson Metal Recycling |

There

has yet to be a major translation to consumers spending money saved on gas at

the pump, but when that happens, steel consumption should rise. At this point, consumers are choosing to save

this extra money. We remain optimistic

that consumer spending will soon rise and will help recycling volumes, prices

and steel production.

There

was bad news for a number of scrap yards and demolition customers last week in

that they received letters from the bankruptcy court for Hayes Iron and Metal,

demanding a “Claw Back”.

A

claw back is when a company goes bankrupt if the court can prove preferential

treatment of suppliers, the court can demand money back that was paid out 90

days, before the bankrupt filing.

There

were no changes to our copper prices in North Carolina last week, with our

Raleigh prices of #1 copper being purchased for $2.36 per pound. Prepared Steel is still being purchased for

$6.25 per hundred pounds.

With

that we hope all have a Safe and Profitable week. Tune in next week for the Commodity and Recycling

report.